Budgeting is a smart strategy for anyone who is interested in paying bills efficiently, saving money, and paying down debt.

No matter where you are in life, budgeting is a great practice. However, there are hundreds of methods to budget and thousands of platforms to use. Some people prefer to budget electronically.

Excel and Google Spreadsheets are viable options to track, but there are online platforms as well. Mint is extremely popular for personal budgeting. Wave and Quicken are great for business budgeting. But it’s important to hand write a budget on a piece of paper.

Handwriting your budget allows for a few things. First, you create a kinesthetic connection to your budget, which enhances your sense of connectedness and responsibility.

Second, you can change it as necessary. Let’s say that your income changes by a penny or two. You can account for that on a physical piece of paper using budget templates without much hassle.

Contents

- The Best Free Pretty Printable Budget Planners, Templates and Worksheets

- Printable budget worksheet for college students

- Free budget template for professionals

- Printable budget worksheet for parents

- Free budget printable template for retirees/fixed income

- Best printable budget planners for beginners

- How do I choose?

- What is a budget?

- Why budget?

The Best Free Pretty Printable Budget Planners, Templates and Worksheets

Let’s look at some of the best free printable budget worksheets out there.

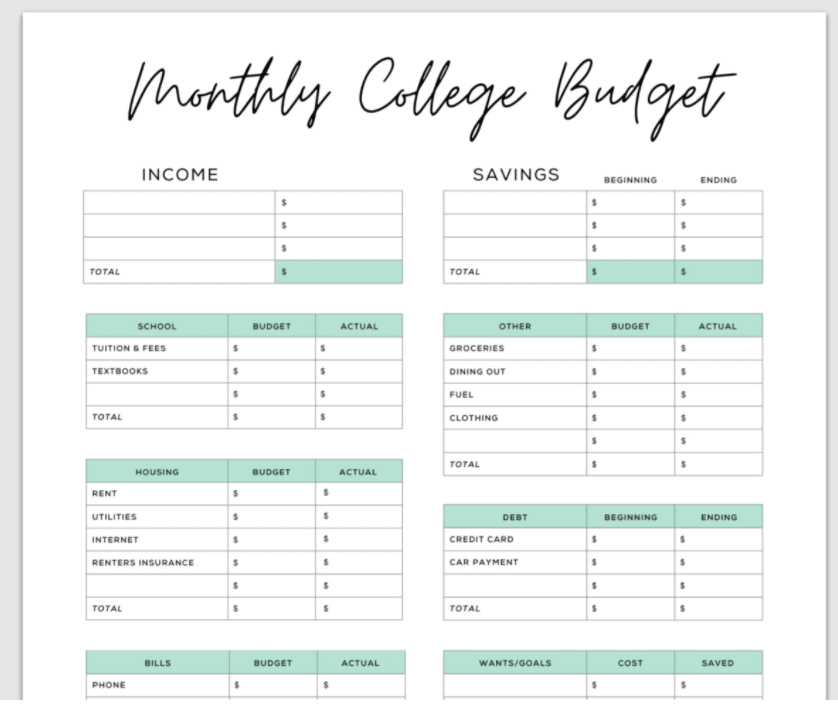

Printable budget worksheet for college students

Budgeting as a college student is difficult. I have two college students and one who already graduated. There are so many factors that fluctuate, but it’s also the first real attempt at adulting.

College Life Made Easy has a great printable for college students. My college students love the preformatted sample’s college components (textbooks, tuition), adulting reminders (renter’s insurance, car payment), and realistic elements (dining out, wants).

They also have other printables that are specific to college students.

RELATED POST: 7 Ways to Save Money as a College Student

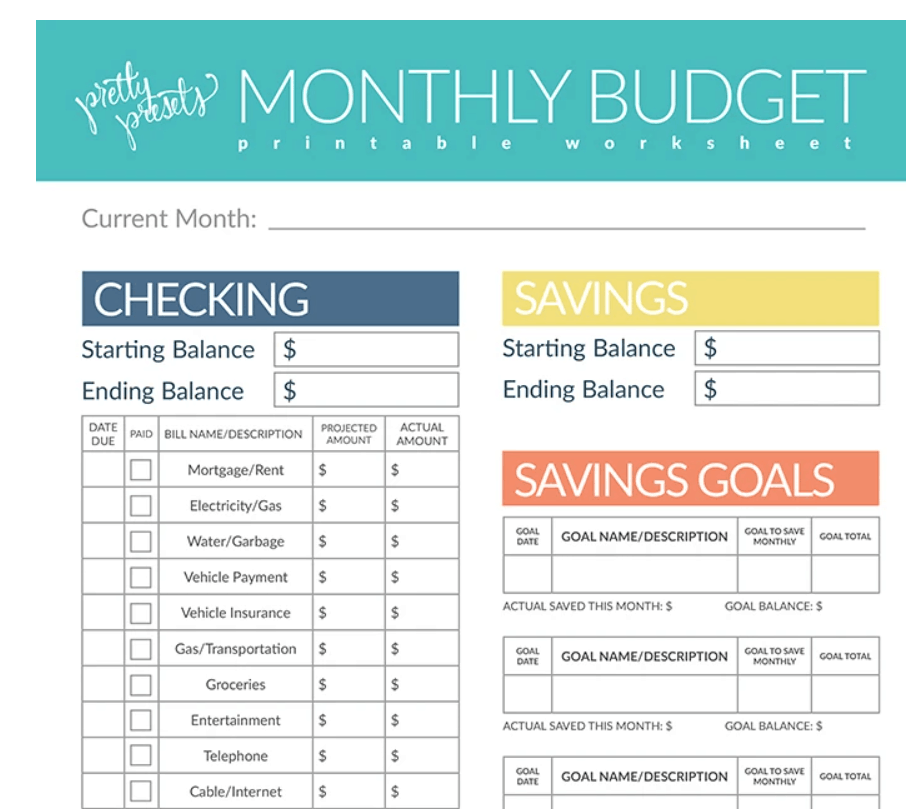

Free budget template for professionals

Professionals have busy lives and little time to spare. They need a no-nonsense budget plan with all of the information in one place.

Pretty Presets and Actions has a straightforward (and still cute) budget printable that includes checking and savings as well as savings goals. It’s simple, makes sense, and has everything you need right on the page.

Their website takes you to a slightly intimidating page when you opt to download. Don’t freak out. It’s still free.

They have additional printables available as well.

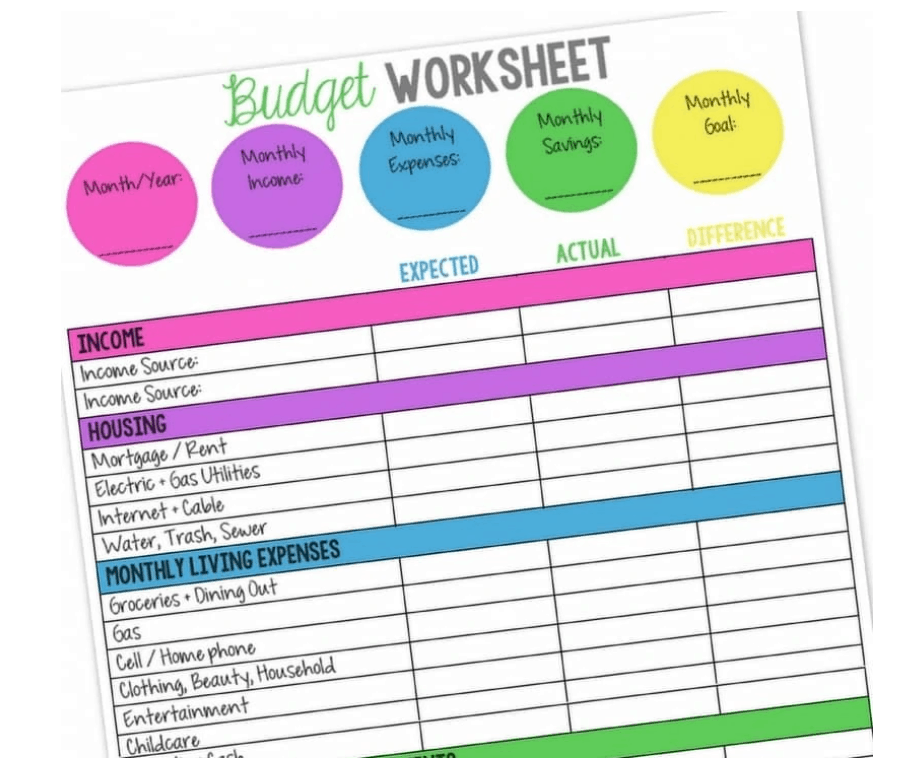

Printable budget worksheet for parents

Parents have different expenses that have to be taken into consideration. Things like childcare and diapers have to be factored into a monthly budget, but it’s also a great idea to start directing savings toward a college fund or a savings account.

A Mom’s Take has a perfect printable for the budget-conscious parent. It includes pre-filled areas that parents need to consider.

It’s a great planning tool for those who are starting out budgeting as well because it features the three categories early-budgeters need: expected, actual, and difference.

Putting a budget together is difficult, so this printable gives you a chance to make mistakes.

Their website includes other budget printables that are great to use.

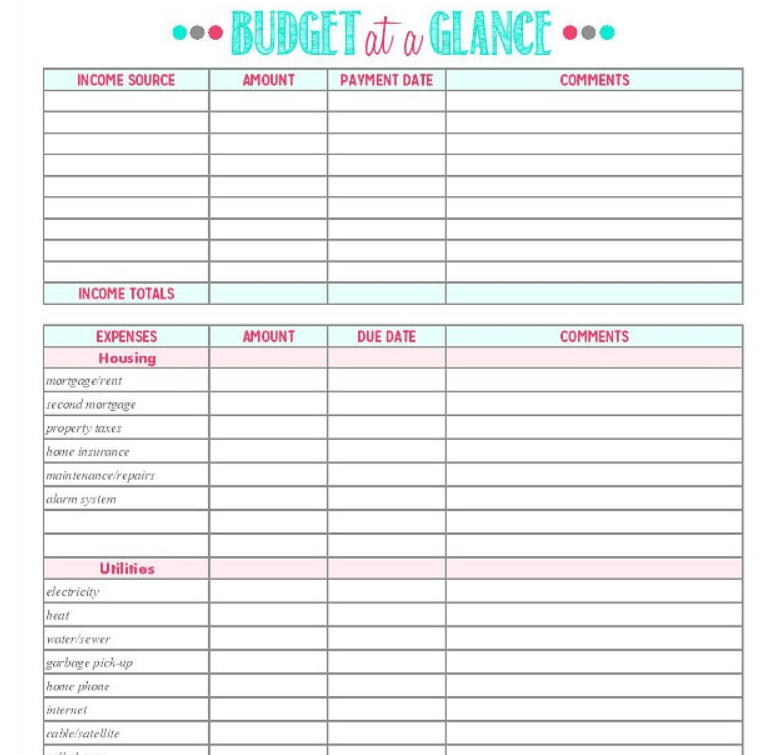

Free budget printable template for retirees/fixed income

If you’re in retirement or on a fixed (set) income, you have the same amount coming in each month. That amount needs to be budgeted, so your variable expenses will be lower.

Clean and Scentsible has some really great options for those on a fixed income. Some of the options available have variable income and expenses, but this clean, clear example shows steady income sources without the need for variety, which isn’t needed when someone has their budget figured out more concretely.

There are a lot of other options in budget printables besides this one as well.

Best printable budget planners for beginners

Bobbi Printables is no-nonsense. You print their guide and go. It’s simple and easy to use.

Microsoft Office has printable budgets in Excel. These are great because most of them calculate for you, but they do not have the handwritten element that is important.

How do I choose?

Budgeting is something that takes time. Preferences change as often as circumstances change. Print out several and try different versions.

No matter which format of budgeting you decide on, the most important acknowledgement is that you’re making strides towards budgeting.

What is a budget?

A budget is a comprehensive plan of where your money goes. It starts with a comparison of income and expenses. Expenses are either fixed (the same month to month) or variable (vary from month to month).

The variable expenses are the ones you have to budget for, which means you are estimating the amount that will be spent on those expenses.

For example, you can budget for your electric bill. You set aside $60 per month for your electric bill. Sometimes, it might be $52.67, and sometimes, it might be $59.23. But it should not exceed $60.

You can adjust your budget, depending on the month and the anticipated usage. For example, in the summer, our household has a higher electric bill (air conditioning) and a lower gas bill (heat), but those prices reverse in the winter months when we use more heat than air. Either way, we still have to pay the bill.

Some items that you budget for are easy to go over. For example, you can budget $50 a week for groceries. Sometimes, you might go over that $50. Usually, it’s for a want instead of a need. So it’s important to use self discipline when it comes to budgeting.

The goal of a budget is to have a higher income than expenses, so you use those extra funds to pay down debt or save.

Why budget?

Budgeting is a great practice that can lead to increased savings. Planning for every penny of income and tracking where every cent goes awaken our sense of responsibility.

If we planned out every penny, we may not be left with extra money each month, so we feel responsible for tracking those funds. Additionally, it helps us notice habits and trends that may be costing us a lot of money.

Martha Warner is a writer, editor, and educator. As a single mom for many years, Martha knows the value of money, how to work hard, and how to hustle. Her freelance career started as a side hustle (to support her love of travel) and quickly grew into the most lucrative career she’s ever had. Martha still teaches at the university as well as other online and in-person courses, including Writing to Make Money, College Scholarship Writing, and Write that Grant. Find out more about her on her website.

This is a helpful list for people looking to start budgeting. We have also been more of the Tracking household (past expenses) rather than Budgeting (estimated expenses). But we’re lucky in that both of us are equally good with money, and our kids are also prudent with spending and able to save.

That’s a great point Caroline! Tracking works well when you have strong self-control. I have one son who is a huge saver; he won’t buy a $7 meal at a restaurant if he knows he can make a meal for $5.