Contents

How to Use Webull App

Investing is an important element of managing your financial life—and modern technology makes it easy with the variety of web and mobile apps on the market.

Right now, there’s a newcomer to the investment app scene called Webull, designed for DIY investors who want to level up their skills and knowledge.

For instance, if you’ve used the Robinhood app for stock trading in the past, you’re probably accustomed to its simplicity: search for stocks, look at their charts, and buy or sell with a single click.

Webull is similar in that it’s app-based and commission-free, but it’s a different level of complexity. When you log in for the first time, you probably won’t automatically know what to do next.

That’s why in this article, I’ll be walking you through Webull’s main tools and features.

Signing Up for Webull

First things first: what you need to know as you open a brokerage account with Webull.

Open an account with Webull to get your 2 free stocks each valued up to $300! Deposit any amount to receive 4 free stocks each valued up to $3000. The stock will be valued anywhere between $8 and $1,000—the higher values are less common, of course, but free is free.

One of the first decisions you’ll need to make is whether to open a cash account or margin account. You can learn more about the difference on Investopedia here, but in short, here’s what it means:

- Cash accounts are relatively simple: you need to have available cash before you can make a transaction. This is perfectly fine for most investors, but day-traders often want to have immediate purchasing power to make quick decisions without waiting for cash to settle in their accounts.

- Margin accounts are more advanced, because they allow you to borrow against your account value to make purchases or short sales. This can be attractive to day-traders, but can also be risky. Many margin accounts charge fees or interest, but Webull only charges interest to margin investors who are borrowing money to short stocks.

If you’re not sure what kind of account to get, the cash account is the safer default choice. You will be able to change account type in the future if you want to experiment with margins later.

(Plus, if you want to actively day trade, you’ll be labeled a “pattern day trader” and need an account value of $25,000+, which is definitely not beginner-level stuff!)

Then, you’ll need to provide some personal details, just like when you sign up for any financial account.

You must be at least 18 years old with a valid social security number.

Be prepared to upload a picture of an ID such as your passport, driver’s license, or state ID, as Webull is legally required to verify customer identities.

The Webull App Interface

Now, I’ll explain the five main screens you’ll find on Webull via the buttons along the bottom of the screen.

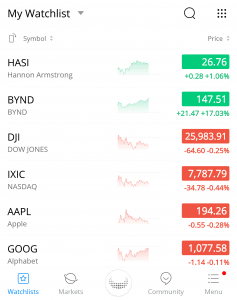

Watchlists

This is the screen where you can keep an eye on both overall market performance (e.g. the Dow Jones) and individual stocks and funds you’re considering.

You can also toggle to “My Positions” to see the stocks you’re holding at a glance, and their performance for the day.

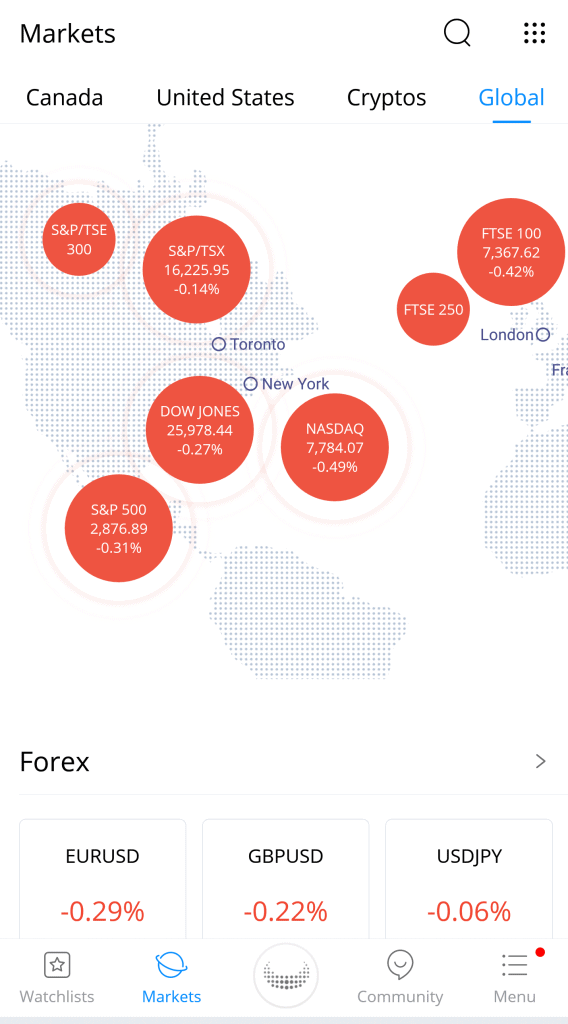

Markets

On this page, you can stay up to date with the news in various markets.

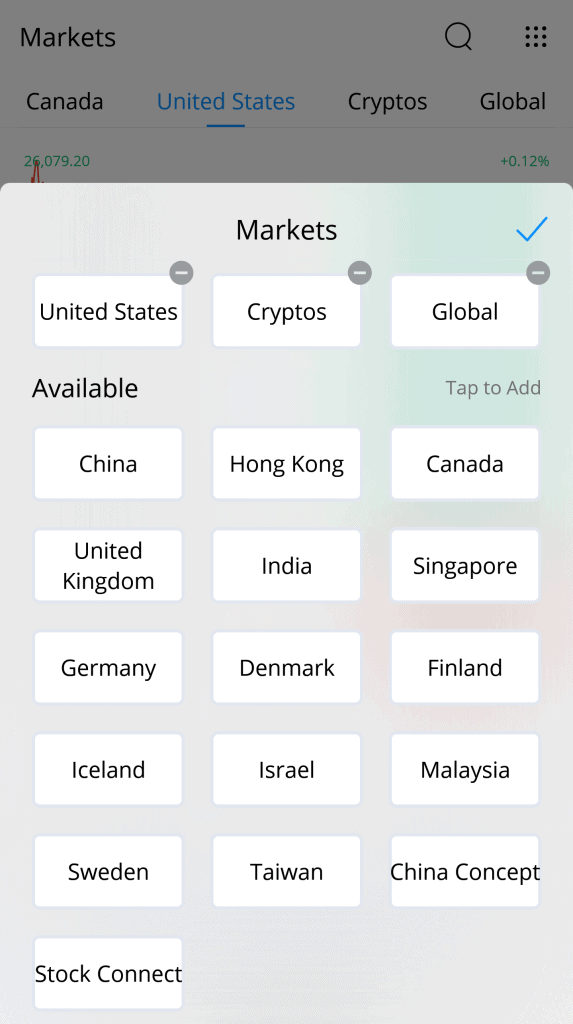

For me, it came with four defaults (Canada, United States, Cryptos, and Global), but you can adjust what you’re watching by tapping the settings icon.

At the time of writing, here are the available markets to choose from:

Also from the Markets page, you can navigate to other pages with useful information, such as:

- IPO Center, where you can see what companies are going public

- Earnings Center, where you can view earnings estimates and quarterly report dates

- Hot Industries, where you can see top gainers grouped by industry (e.g. pharmaceuticals, gold, electric utilities, etc).

- Hot ETFs, where you can find well-performing exchange-traded funds (also grouped by industry)

- Hot Stocks, where you can find a list of popular individual stocks

- Rankings, where you can sort stocks by most active, top gainers, and top losers

As you can see, the Markets page is a useful place to be.

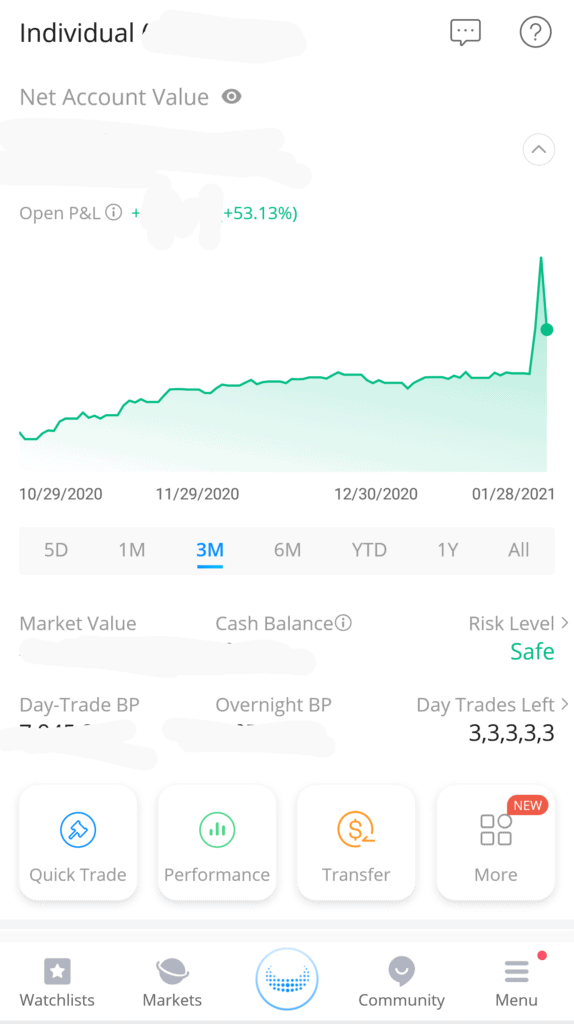

Webull Home

This button in the center is marked by the Webull logo. This is where you’ll find a summary of your account and a variety of actions to take.

From this page, you can navigate to:

- Quick Trade: Trade stocks (we’ll get more into this process below)

- Performance: View your overall account profit and loss

- Transfer: Deposit or withdraw money or stocks

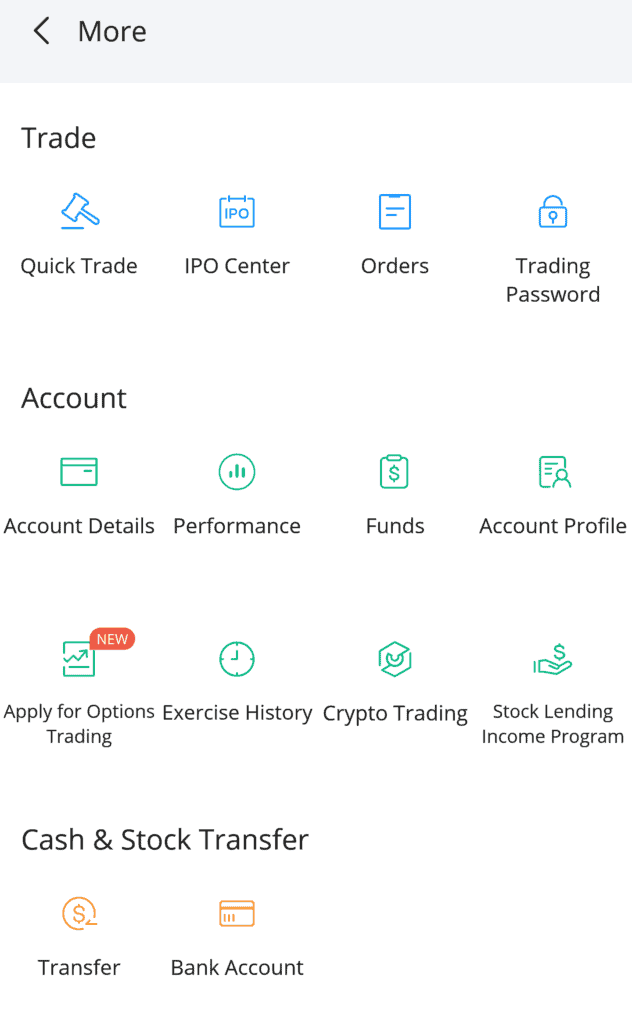

Hit the More block for these other options:

- IPO Center: View and order Initial Public Offerings

- Orders: View and sort all of your orders

- Trading Password: Change your password or set a fingerprint ID

- Account Details: See your account type, value, asset allocation, buying power, risk level and dividends

- Funds: View financial information like deposits you’ve made, dividends you’ve received, trade costs, etc.

- Account Profile: See and update your personal info like address, phone number, ID, and account beneficiary

- Apply for Options Trading: Apply to become eligible to trade options contracts on Webull

- Exercise History: If you trade options, you’ll see the history of options you’ve exercised here

- Crypto Trading: Trade assets like Bitcoin and Ethereum

- Stock Lending Income Program: Lend your stocks to Webull in exchange for interest

- Bank Account: View the bank you linked and add others if you want

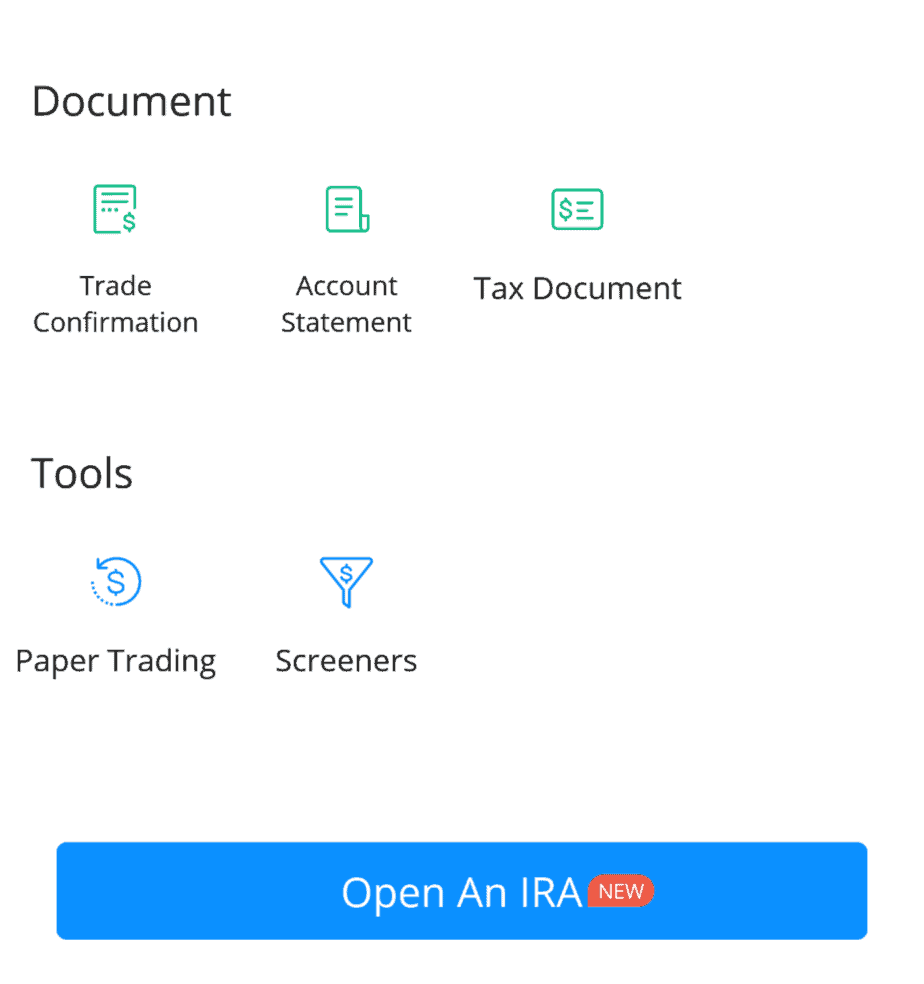

- Trade Confirmation: View daily reports from days with trading activities

- Account Statement: Find and download your monthly statements

- Tax Document: Get your tax documents from Webull before you file

- Paper Trading: Play around with a fake portfolio to help you learn how to trade

- Screeners: Filter stocks by certain criteria (e.g. region, price, dividend yield) to potentially help you find new stocks to invest in

Community

Here, you can check out stock news to see what news organizations and analysts are saying about top news and the stocks on your watchlist.

You can also keep up with Webull updates and other users on the Streams page, where you can make your own posts or like and comment on others.

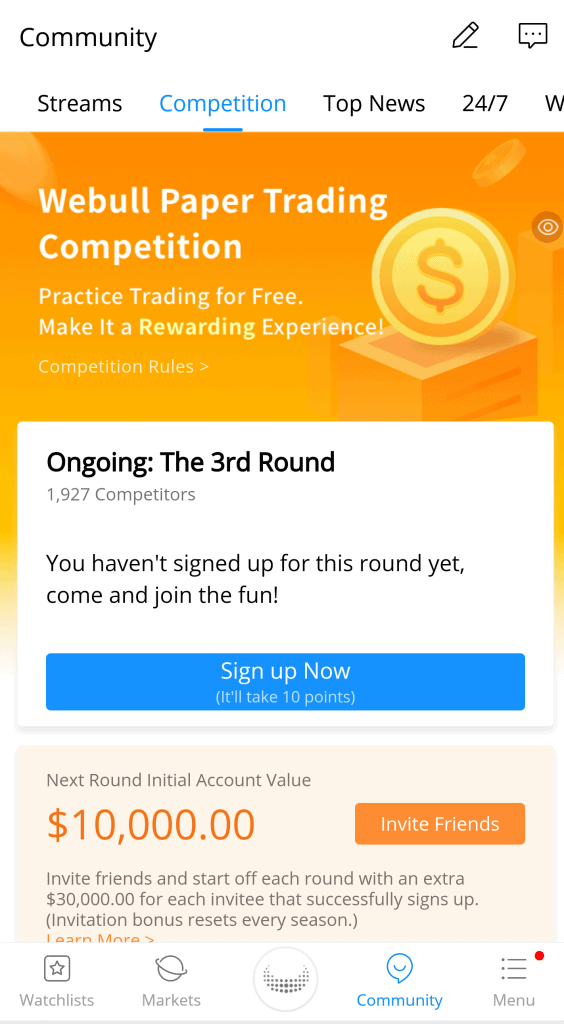

From the Competition tab in this area, you can enter the Webull Paper Trading Competition, where you can practice trading for fun and compete with other users to see whose practice accounts perform the best.

It’s free and winners receive Amazon gift cards.

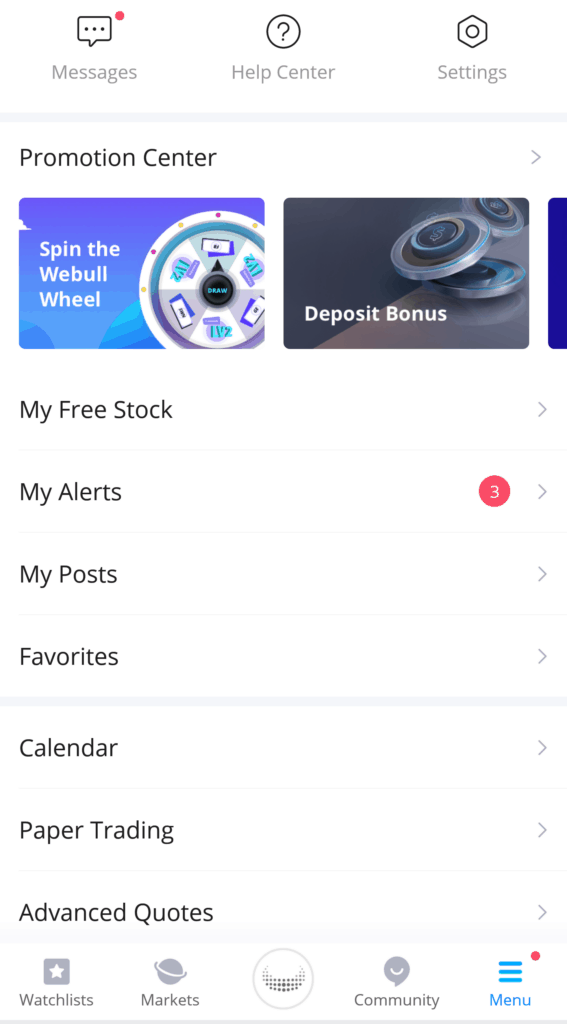

Menu

Last but not least, the Menu page is where you can handle logistics. Access the Help Center, change settings like your password and app defaults, manage alerts, claim your free stocks for signing up, etc.

How to Trade on Webull

Now that you know how to find your way around Webull, I’ll zoom in on the most pertinent activity and show you exactly how to make a trade on Webull.

First, of course, you’ll need to choose a stock or ETF you want to buy. You can do outside research or use Webull’s features to browse options.

Once you’ve made a selection, click the center Webull logo button and then Quick Trade.

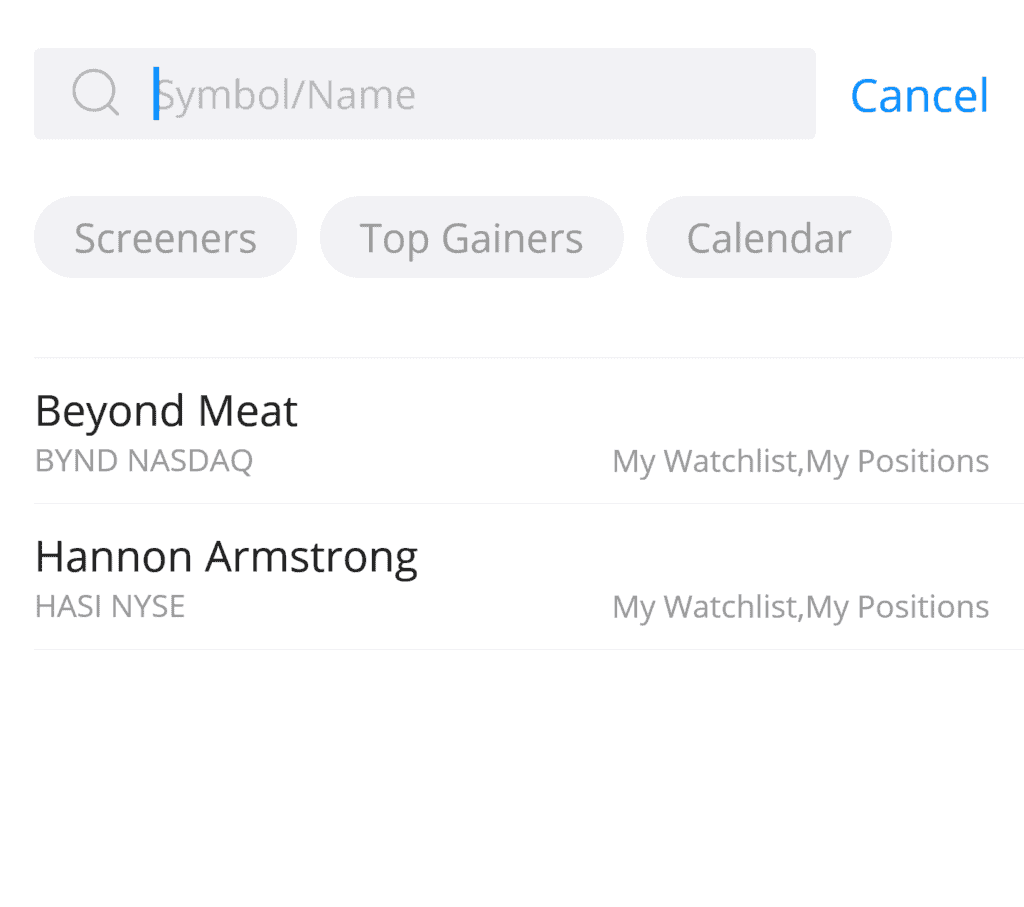

Type in your desired symbol or name, which brings up this page:

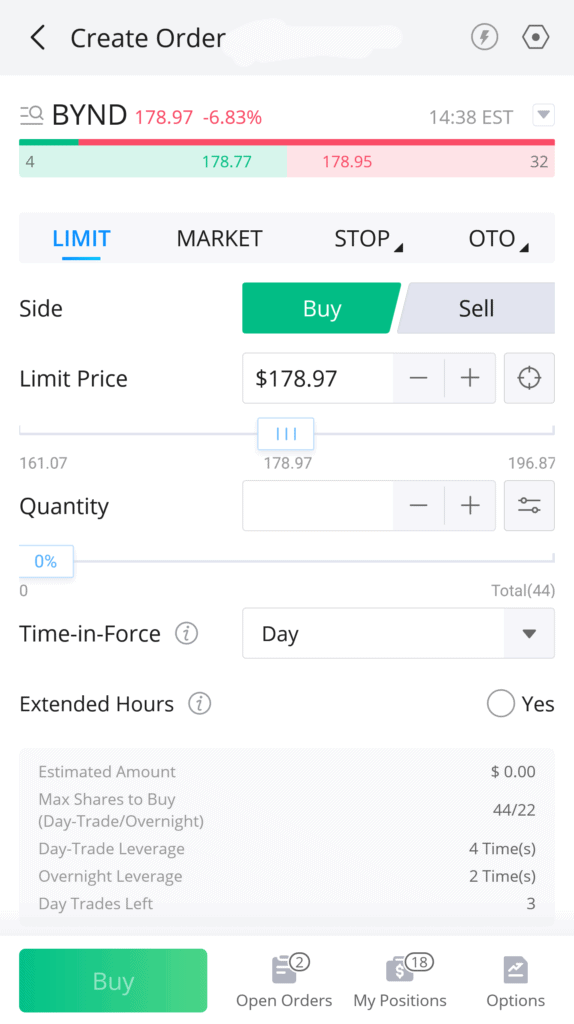

Some of this is fairly intuitive, like whether to check Buy or Sell, choosing how many shares you want. There are three settings that require a little more knowledge: your order type (Market, Limit, etc), Time-in-Force, and Stop Loss/Take Profit.

Order Type

There are four order types you can choose from in Webull:

- Market order: you immediately buy or sell the stock at whatever price it is when the order executes.

- Limit order: you can set an order to automatically execute when a stock reaches a certain price (e.g. the price is currently $100 but you only want to buy it if it falls to $90). This means you can set possible trades without having to constantly watch a stock’s fluctuations.

- Stop order: will change to a market order when a stock falls below a price you specify

- Stop limit: will change to a limit order when a stock is at or better than the price you specify

One main difference between regular orders and stop orders is that stop orders can’t be seen by the market until they’re triggered. Learn more about the differences here.

Time-in-Force

If you’re setting a conditional order like a limit or stop order, this lets you specify whether that trade will only apply for that day, or if it’s good until you actively cancel it or it expires after 60 days.

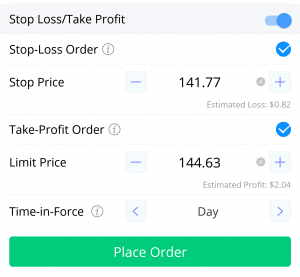

Stop Loss/Take Profit

Clicking this toggle brings up two more options that are conditional on the primary order you’re placing.

You can set a stop-loss order to place a conditional market order, usually in an attempt to mitigate losses if your primary order executes and then falls even lower.

Or, you can set a take-profit order to place a conditional limit order, usually to lock in profits if your primary order executes and then the stock goes higher.

As you can see, trading on Webull is a little more involved, but it does help give you a better feel for working with real markets.

To conclude, if you prefer long-term, hands-off investing, that’s a great choice and you’ll be fine with an account that you just check on periodically at Wealthfront, Vanguard, etc.

However, if you have a little extra “fun money” and want to learn about the world of active trading, opening an account with Webull will certainly be an educational experience. Sign up and deposit any amount to earn your free stocks and try it out.

Kate is a writer and editor who runs her content and editorial businesses remotely while globetrotting as a digital nomad. So far, her laptop has accompanied her to New Zealand, Asia, and around the U.S. (mostly thanks to credit card points). Years of research and ghostwriting on personal finance led her to the FI community and co-founding DollarSanity. In addition to traveling and outdoor adventure, Kate is passionate about financial literacy, compound interest, and pristine grammar.

I came here to learn basic buying on Webull. I checked the article date because everything is so different. Wow, so much change in so little time.

I want to purchase TSLA stock, which is trading over $700. I am new to the stock market. I deposed $100 to start. Can I purchase a portion of a stock or must I purchase 1 or more of stock?

I know an Australia stock that I’m interested in buying. Can foreign stock be purchased in Webull?

im searching for instructions on how to buy stock on webull on windows not the phone app