At 21 years old, I was a new college graduate with sixteen years of education behind me, a professional writing degree, a couple dollars to my name, a job + a few side hustles, and zero clue about banks, credit cards, retirement funds, the stock market, or where to begin learning to invest.

Although I’d enjoyed math classes I’d taken in school–and was occasionally guilty of participating in algebra competitions for fun–there was a definite practicality gap in their focus. I could use the quadratic formula in my sleep, but compound interest and dividends…not so much in my vocabulary.

Back then, I thought of investing as something for high-powered lawyers and Wall Street traders with suits and briefcases, not writing majors buying jeans on clearance. It seemed inaccessible; a separate world. But I dived in anyway, and you know what? I quickly discovered that you don’t have to be an expert to learn to invest or be a successful investor. In fact, I’d argue that many “experts” are more prone to believing they can time the market (you can’t) and making overconfident moves that ruin them.

So, you don’t have to know all the investing terminology or have a five-year market forecast in order to begin investing. Simple investment strategies tend to be the best ones anyway. Here’s how to start learning to invest with little money as a beginner.

Our Popular Investing Apps

- Acorns

- $10 sign-up bonus

- Invest your spare change automatically

- Make money while you sleep

- No trading fees

- Fundrise

- Invest in real estate with $10

- No accreditation requirements

- Passive investment

- Over 260,000 active investors

Contents

1. For Free Money: Matched Company 401(k)

If you work for a company offering to match a certain percentage of your 401(k) contributions, setting that up should be your first priority as a new investor.

Why? It’s literally free money.

Every company will handle this differently (though some don’t have it at all). Some will have a program like matching 50% of your contributions up to 6% of your income. That means if you have a salary of $50,000 and set your 401(k) contributions to 6% of your salary, you’ll be contributing $3,000 over the year. Your employer will add an extra $1,500 on top of that.

Some companies do a full dollar-for-dollar match instead–so perhaps their program matches 100% of your contributions up to 4% of your income. Someone making $50,000, in this case, should contribute 4%, or $2,000 over the year. The employer will then add another $2,000.

To begin, look through any documents you were given when you started your job–retirement fund details should be included. Or you could ask your HR or payroll department how to get started.

Importantly, if your company does have a matching program, I would advise only contributing up to the match amount. In other words, if they offer a match up to 6%, only contribute 6%. If you have extra money beyond that, put it into a personal retirement account instead, which I’ll talk about next.

If your employer doesn’t have a 401(k) program, or they don’t offer a match, no worries: it’s easy to invest on your own. Moving on to #2…

2. For Hands-Off Diversified Investing: Wealthfront Brokerage

The key to long-term investment success usually comes down to one simple thing: diversification. This is the stock-market version of “don’t put all your eggs in one basket.” Even when you’re just starting to invest, you want a wide mix of assets across a wide variety of classes and industries. Why? Because the truth is, some will succeed and some will fail–and you don’t want to be over-exposed in the ones that fail.

But new investors, especially ones that are just learning to invest and don’t have a lot to put in the market yet, can’t be expected to pick out 200+ stocks to build a diversified portfolio on their own. And if they do, it will cost a lot in time and money, because a lot of investment managers charge high fees or have steep minimum investment requirements.

That’s what makes Wealthfront so amazing: you can open a retirement account (or regular investment account) through them with as little as $500, and automatically have a fully diversified portfolio. If you sign up with a referral, your first $5,000 is managed for free (and once you exceed that the fees remain incredibly low). It’s the definition of investing made easy!

I’ll explain how it works and show you my portfolio in a second. If you like the sound of it, you can get your first $5,000 managed with NO fees by signing up here.

Here’s how it works.

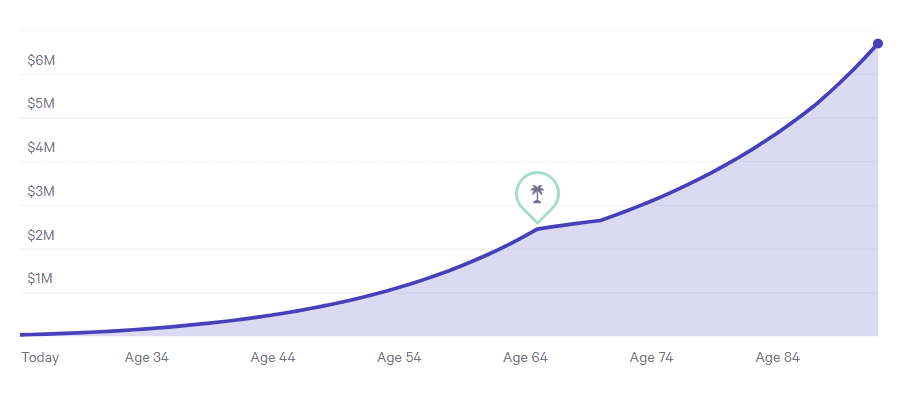

I’d recommend opening a Roth IRA as your first retirement account. They’re great accounts because any withdrawals you make after age 59 ½ are completely tax-free. You can contribute up to $5500 per year, and you can take out what you’ve invested at any time. but you can never go back and make up years you’ve missed. In other words, you can’t go back and make your 2018 contribution when it’s 2028. That makes it important to start investing in a Roth IRA as early as you can. If you start learning to invest and contributing in your 20s, your accounts will have a lot of time to grow.

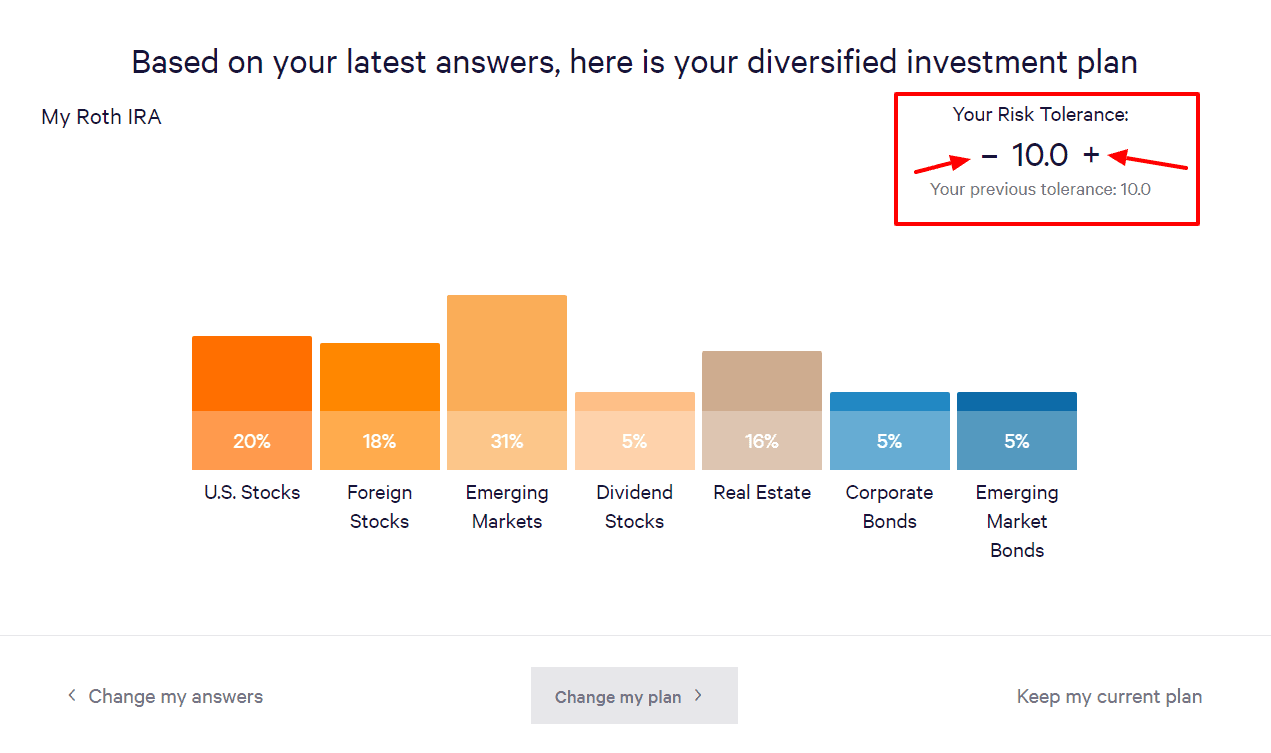

When you set up your account, you’ll take a short questionnaire to assess what your risk tolerance should be. At the end, you can accept their recommendation or set your own using the plus or minus keys (see image). You can play around with them to see how your asset mix will change based on your risk tolerance, then save when you’re satisfied.

If you’re young, I recommend setting a high-risk tolerance, because even if there are market crashes (which there will be), you have years for reaping the gains in between crashes (and recovering from the ones that do occur). As you can see, my tolerance is set to 10, which is the maximum.

The higher your risk tolerance, the higher proportion you’ll have in investments that are considered riskier, like emerging markets. The lower it is, the more you’ll have in stable, more “crash-proof” assets like bonds.

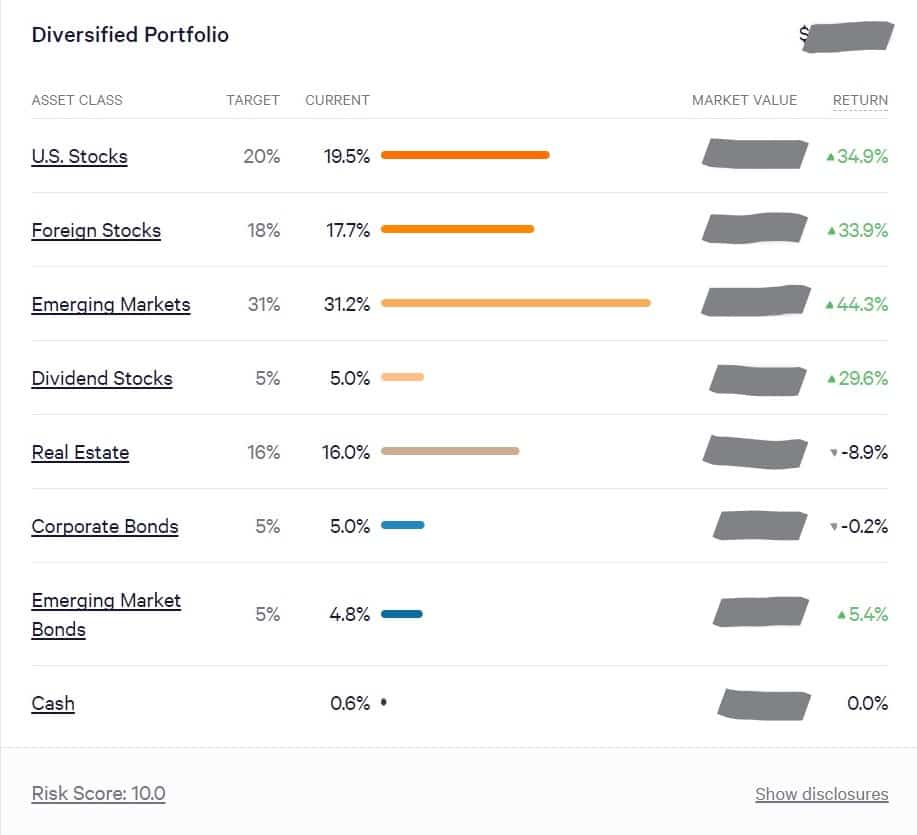

Have you heard the saying “high risk, high reward”? In the investment world, you can see this play out first-hand. Take a look at the returns from my portfolio. You’ll notice that the highest returns have come from the riskiest asset class (emerging markets), while some of the lowest come from bonds–the “safest”:

That said, they’re not called risky for nothing. Markets can be volatile, and during crashes, the “safe” stocks and assets will hold their value much more steadily. This makes low-risk tolerance a wise choice for older investors, who will need their money sooner and have less time to wait for recoveries.

As long as you’re thinking long-term, I wouldn’t get too caught up in day-to-day portfolio valuations when learning to invest. Set up an automatic transfer from your bank account–whatever amount you can afford per week or per month–and just check in every once in a while.

Wealthfront is a very hands-off platform for those who like investing made easy, so unless you’d like to change your risk tolerance, there’s nothing you need to do to actively manage your portfolio.

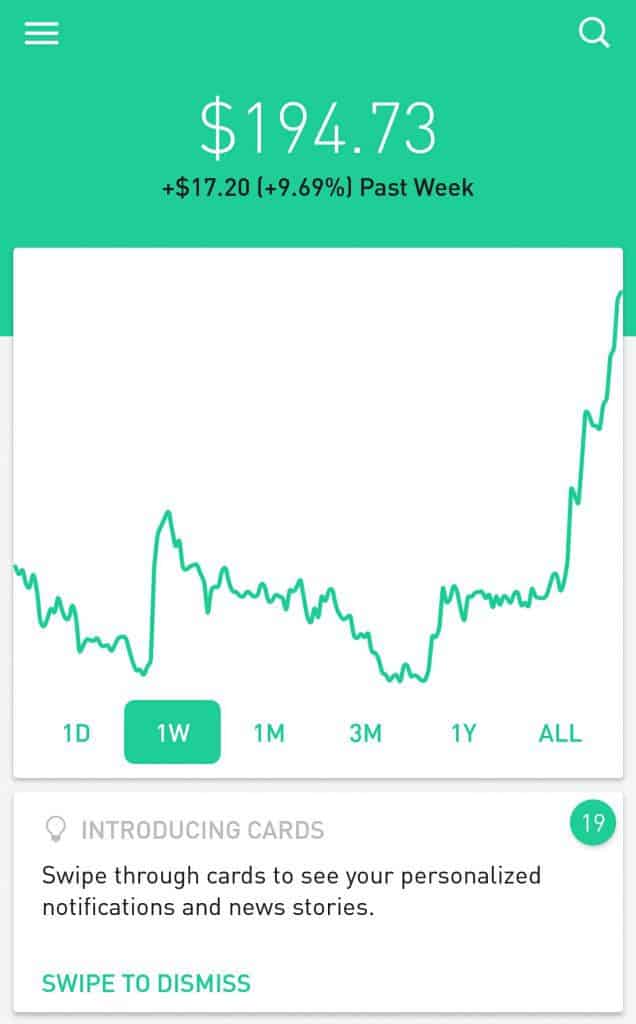

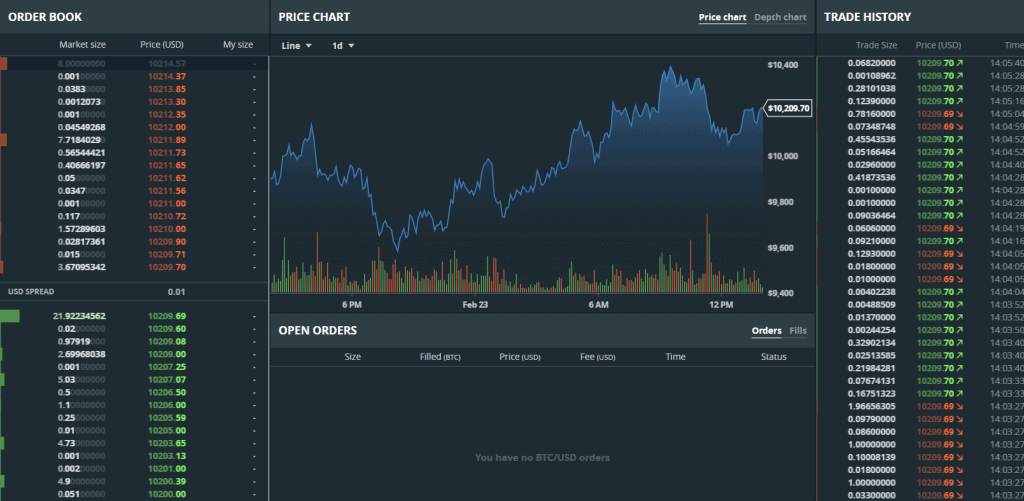

3. For Individual Stock Trading: Robinhood

There’s no better way to test the waters of stock trading than the app Robinhood. Unlike traditional exchanges, where fees can run $5-20 per trade, Robinhood allows you to trade as much as you want without fees. This makes it ideal for investors who want to invest with little money and get a feel for researching companies, buying and selling individual stocks, and managing a portfolio, even if you just want to play with $50 or so.

Feel free to use my link to get a free stock if you decide to sign up.

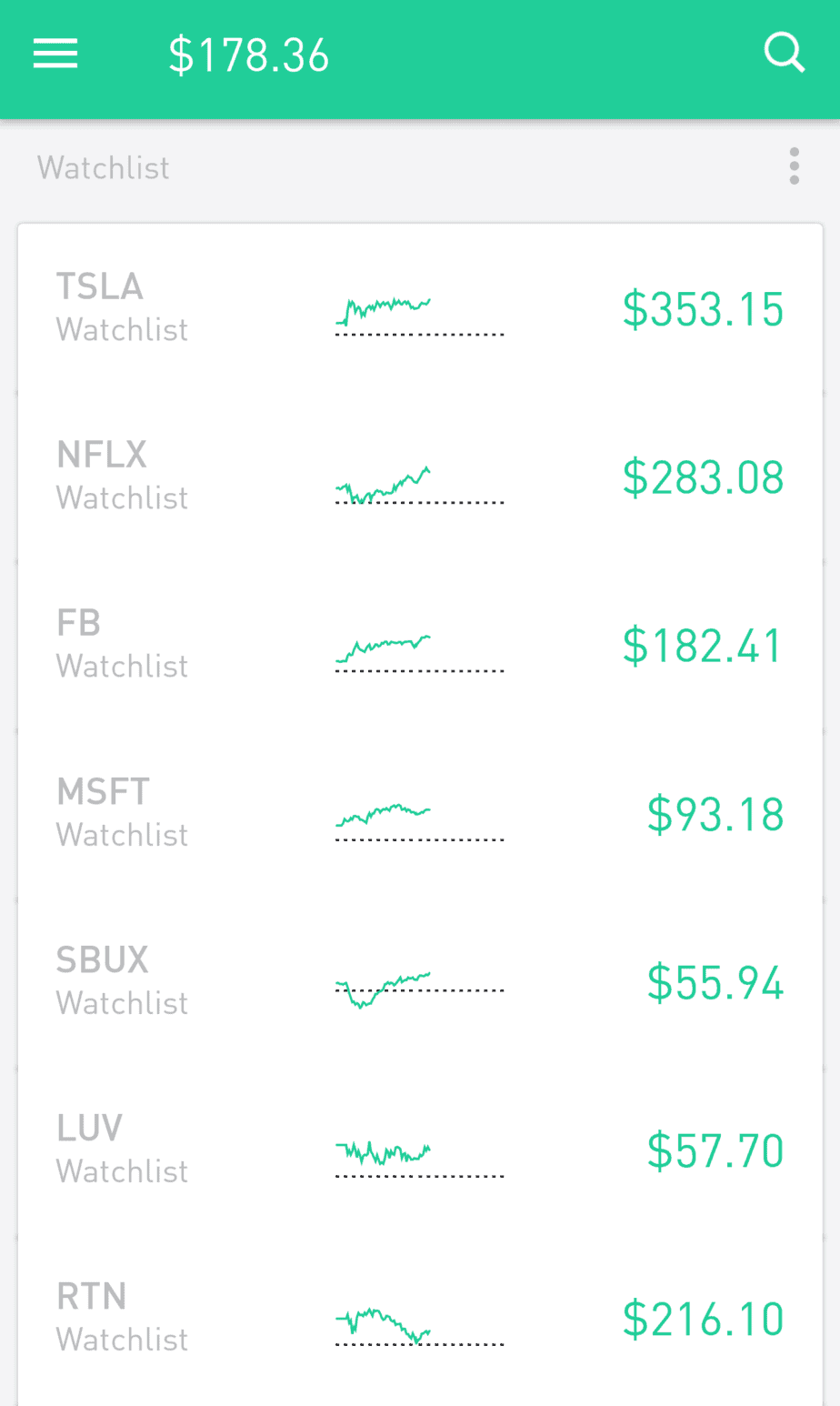

Here’s what the interface looks like:

The graphs show you how your overall portfolio value has changed in the given time frame–day, week, month, and so on. (I just put in $150 to do a little day trading, so I haven’t done too terribly so far.)

Honestly, trading individual stocks is a lot more hit-or-miss and a lot less guaranteed than diversified index funds through Wealthfront or other investment firms. However, it’s kind of fun to research companies and pick ones you want to support. I like to invest in clean energy, medicine, and education, and with Robinhood, I can buy stock in companies working on those things.

Robinhood displays popular stocks and their values right on the front page of the app when you scroll down:

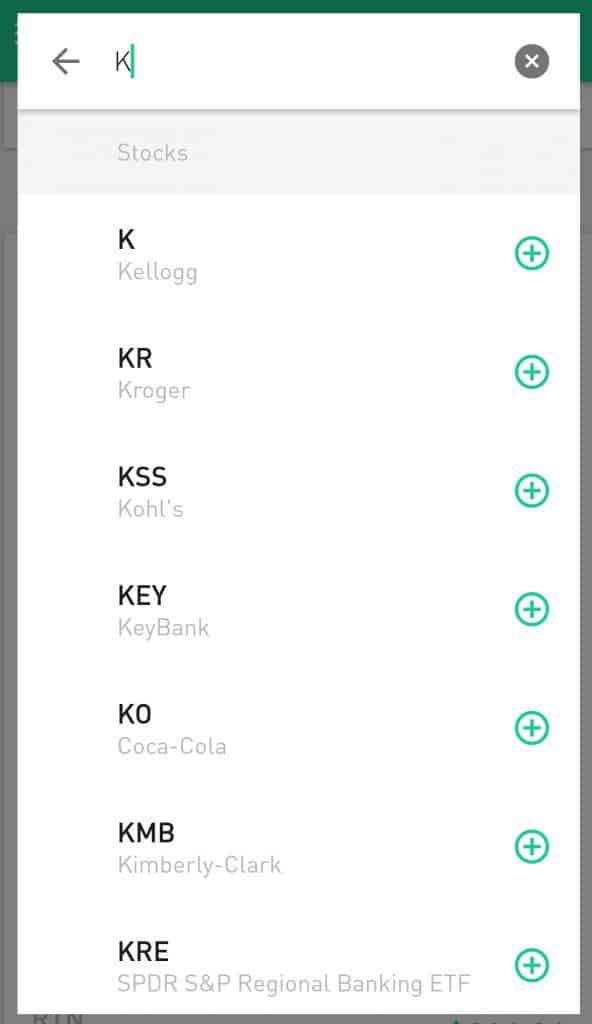

You can look up other companies or stocks using the search icon on the top left:

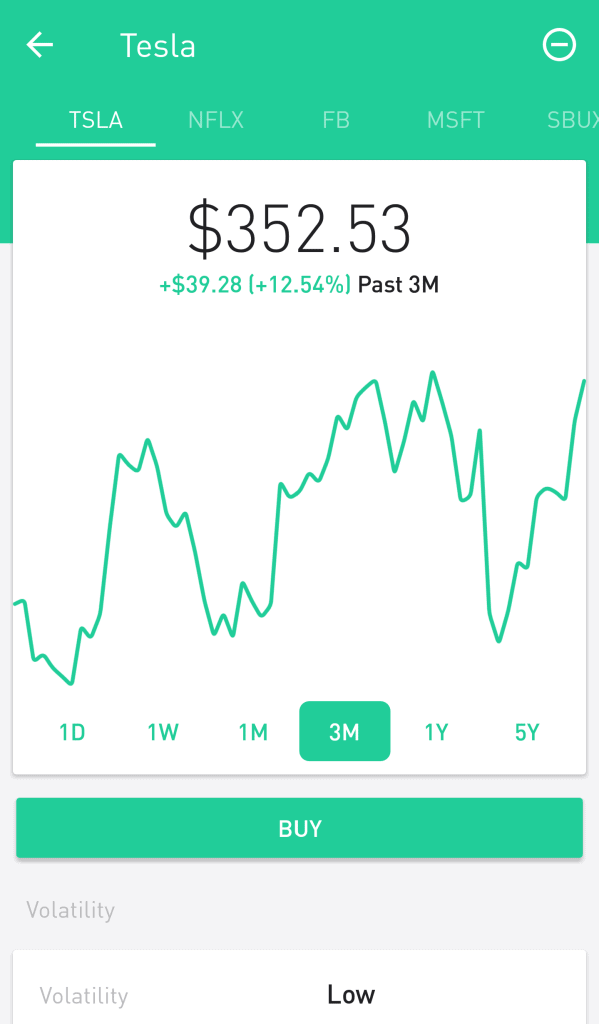

And to buy a stock or see how it’s been doing over the past few weeks, months, or years, just select the one you want to look at and toggle between the performance graphs:

One reason the Robinhood app is fun: since it lets you trade without fees, you can try your hand at active trading (buying stocks low and selling them higher a few days/weeks later). I don’t recommend this as a long-term investment strategy at all, but if you have a little spare cash and want to see what active trading is like, it’s a good learning experience.

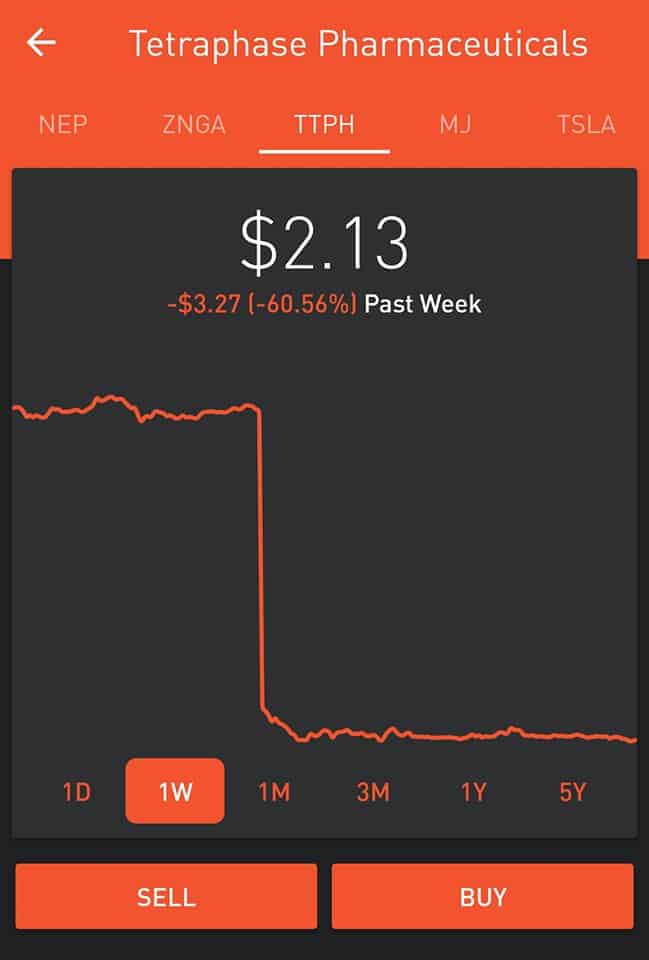

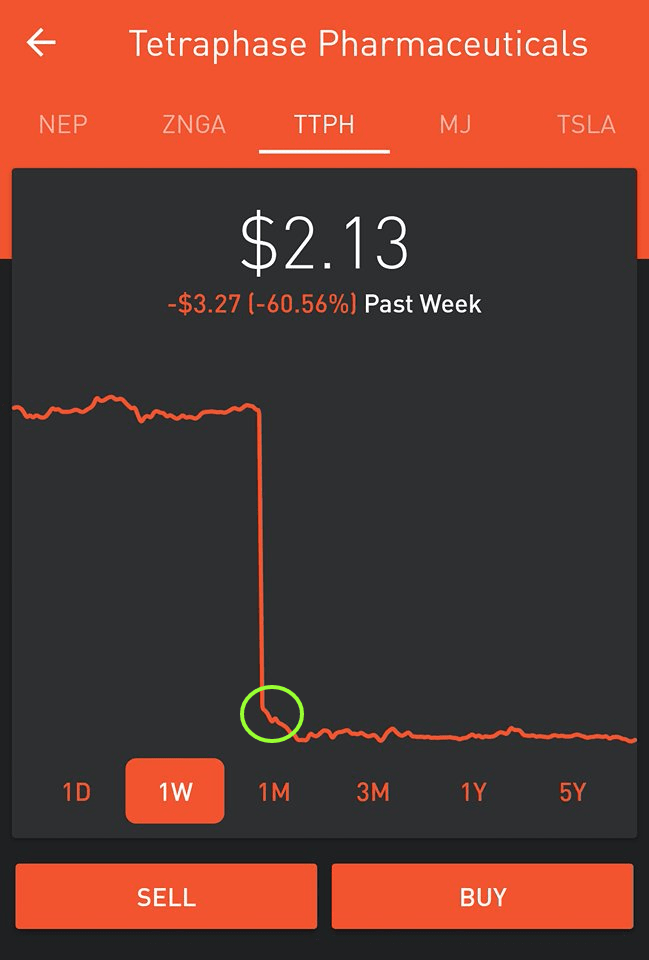

Here’s an example. I’d been keeping an eye on a company called Tetraphase Pharmaceuticals, which develops antibiotics for serious bacterial infections. I had a few shares already, which meant I got notifications when it did anything significant.

Then, Tetraphase plummeted about 60% in a single day.

I actually love stock crashes. I see them as opportunities to buy in cheap to good companies. But before making any moves, I did some research on what had caused the fall. Turns out, one of their antibiotic trials had failed. However, they were still working on other promising projects, and the company had a solid performance history, so I interpreted this drop as a temporary reaction from investors. I quickly sold some of my other stocks to free up my in-app cash for TTPH.

Here’s where I bought in–right around the bottom of the crash:

Essentially, what I did was make a bet on the company to recover. Time will tell if that bet pays off or not. Maybe it never will recover–that’s always a risk you take when trading. Nobody can time markets with certainty; all you can do is make educated guesses and let the chips fall where they may. (UPDATE: A couple months after I wrote this, TTPH had recovered to about $4. I sold half my stocks and kept half. Now, a year later, the stock is worth only 43 cents. This makes it a perfect example of that element of risk I’ve been talking about, and why you shouldn’t put all your eggs in one basket!)

If this sounds fun to you, download the app and try for yourself!

Check out my detailed guide on How to make money with Robinhood.

4. For The Risk-Takers: Cryptocurrency

If the value of the stock market ever plummeted 50% in a single day, there would be mayhem and panic. In the cryptocurrency world, it’s just a normal day.

However, the asset also has given massive returns to those who invest at the right time and refuse to sell out of fear during crashes, so make of it what you will. (I’ve seen my valuations multiply and crash so many times that I’m becoming immune to it now.)

The easiest way to start buying cryptocurrency is through Coinbase. They currently offer four cryptocurrencies: Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. Bitcoin is the “first player” and has the fame, but my favorite of the four is Ethereum, due to its smart contracts technology that give it more real-world use cases than the others.

Again, just like individual stock trading, I’d recommend only putting your “play money” into cryptocurrency. Please don’t invest any amount you couldn’t afford to lose. Your $100 could double overnight or be worth $1 by the morning (it’s a drastic example, but you should be prepared for anything).

5: For Hands-Off Real Estate Moguls: Fundrise

Have you ever been curious about investing in real estate, but you cringe at the thought of dealing with constant maintenance, unpleasant tenants, messy houses, legal complications, and the other difficult aspects of home ownership and landlording?

Me too! I’ve never been interested in building my own personal real estate empire with a lot of physical land and buildings. But I still know the importance of diversifying your investments with a wide range of asset classes, and real estate is certainly one of those! When the stock market is down, real estate can be up. When bond interest is low, real estate interest rates are also low and it can become an attractive investment.

So, how do you invest in real estate without buying real estate?

Answer: by signing up to invest with Fundrise!

Fundrise allows you to invest in real estate with as little as $1,000. They offer a collection of private REITs (Real Estate Investment Trusts), which are diversified funds of commercial real estate investments. While you can also buy other publicly traded REITs yourself through Robinhood or another brokerage, the ones on Fundrise are not publicly available. Real estate is their specific area of expertise, so that’s the only type of investing you’ll do on the platform.

You can see Fundrise’s current and completed real estate projects here, which include everything from single-family rental homes to apartment buildings to warehouses and more.

You can choose to manage your portfolio automatically or manually. Annual fees amount to 1% of your portfolio value per year, meaning if you do start with $1,000, the annual fee will be $10. Grow it to $10,000 and you’ll pay $100/year, etc.

Explore the Fundrise platform to learn more and sign up here!

Simple Rules For Successful Investing Made Easy

No matter what kind of platforms or stocks you choose while learning to invest, use these principles to manage your money wisely.

1. Diversify. I mentioned this earlier while talking about Wealthfront, but it bears repeating. If you have all your money in one stock and it fails, you’re out 100%. If you have 100 stocks and one fails, you’re out 1% (which will in all likelihood be covered and exceeded by the gains from the rest).

2. Think long-term. If you bought $5,000 worth of stocks and then there’s a crash so they’re only worth $4,000, you only truly lose money if you sell and lock in your losses. Recessions happen. Historically, recovery has always followed. The people who sell when markets are low always regret it later. Be cool, don’t panic, remember your 20-year or 30-year or 40-year plan, and ride out the storms.

3. Keep some liquid funds on hand for emergencies (aka money in a regular bank account), but otherwise, invest as much as you can afford. Bank accounts will pay you maybe 1.5% interest per year if you’re lucky. The average annual performance in the stock market is 7%. Factoring in inflation, you could actually be losing money by keeping too much cash. Unless you’re saving up for a big purchase like a house downpayment or car, I’d recommend keeping about 6 months’ worth of expenses in a bank account and investing the rest.

4. If you think you can’t afford to invest or contribute to retirement funds…find a way and start investing anyway. Start a side hustle or cut expenses in your everyday life to save. Too many people find themselves getting older with no safety net. Your future is too important to ignore, and the sooner you start, the more time your portfolio value will have to grow.

How old were you when you first started learning to invest? What are your tips for beginners who want to invest with little money? If you’re new to this yourself, what questions or thoughts do you have? Comment below!

Kate is a writer and editor who runs her content and editorial businesses remotely while globetrotting as a digital nomad. So far, her laptop has accompanied her to New Zealand, Asia, and around the U.S. (mostly thanks to credit card points). Years of research and ghostwriting on personal finance led her to the FI community and co-founding DollarSanity. In addition to traveling and outdoor adventure, Kate is passionate about financial literacy, compound interest, and pristine grammar.

I have just 3-4 thousand

How to invest it stack market

That’s enough to start! If you’re in the U.S. I would put it into Wealthfront (see section #2 in the article). I can’t give investment advice for other countries unfortunately if you’re not U.S.-based.

Any recommendations for the almost college grad with not a lot in the bank? ~1k

With only $1k, I’d keep it liquid for emergencies or post-grad expenses that arise. Maybe take $50-100 to put in Robinhood or Coinbase if you want to get a feel for investing, but otherwise I’d wait until you have steady income. As soon as you do, I’d say open the Roth IRA with Wealthfront unless you’re hired at a company with a matching program.

Also, take a look at the interest rates of the bank you’re currently using. Most local banks don’t pay great interest, but there are some online banks (I use Ally bank) that give better interest on savings accounts. What I did was I kept my account at the local bank so I could make cash deposits and withdrawals, and then I also opened an account at Ally where I transferred all of my savings. That way you get the best of both worlds.

how can i start if I have 5000 RS …..

I landed here from Quora. I’ve always wanted to learn about the stock market but don’t know where to start.

Please advise me how I can invest $1000.

Hi Olivia! If you have a workplace 401(k) with a match, I’d start there. If not, I’d choose one (or all) of these, assuming you’re from the U.S.:

1) Open a Roth IRA with Wealthfront. You can answer a few questions to determine your investment strategy, then contribute $1,000 and they’ll automatically invest it in diversified funds for you. Very beginner-friendly and there’s no administrative effort on your end.

2) Sign up for the app Acorns. This one lets you invest on a recurring basis without thinking about it because it invests tiny amounts when you make purchases. You can take some of your cash to make a one-time investment too. It does the same thing as Wealthfront where it diversifies all your contributions for you.

3) If you want to be a little more hands-on and explore buying and selling individual stocks, the app Robinhood is great for that. It’s fun getting to pick your own stocks, but also a little riskier.

Personally, I use all three, since they’re all extremely simple to use and let me do a variety of things. If you’re interested in doing something like that, I’d put $600 in Wealthfront, $200 in Acorns, and $200 in Robinhood. Then experiment and see what you like best! I wrote about them in greater detail above, but that’s the “tl;dr” version. Let me know if you have other questions!

Hello, I am in USA but I am not from here, I do not have any credit or debit card, How can I start an investment if I am living here just as a tourist?, Are there any bank that let tourist open an account?, greetings

I’m not qualified to answer that one, but this article looks like a good resource!

Hi Kate

I came across your guide to start investing. I have always wanted to lean but it seemed so complicated and caring for a family, I really never felt I had the time. I am now retired with some extra funds so I am going to check out the robin hood app per your suggestion. You made it sound possible to start learning, so I am goin to try. I know I will enjoy the challenge but will start small. I never really thought myself capable of learning. Though late in life, I plan research it and YOUR ONLINE SUGGESTIONS ARE MY CATALYST.

That’s awesome to hear! I have full confidence in you. Clearly you made it to retirement so you’re doing something right!

Oh Kate,thanks for the information however our economy is unpredictable but ,I’m gwg to forces on savings and plant trees and set up one roomed house complete with kitchen for retirement, in ten yrs , I’m 43yrs ,I believe I will make it

I’m not sure where to start. I’m very new to investing and don’t know much. I’ve had Acorns for about 2 months and I have $400 in It. I tried Robinhood but it was a little intimidating so I left. I seen your article about Acorns so now I’m a little iffy on that. So far I like it but I’m iffy now. I just finished reading up on Fundrise. It sounds interesting. Im 34 and I don’t have kids or a true job. I don’t really go out anymore. Rent is cheap. Car is paid for. I do pretty well with odd jobs so I’m able to invest probably $400-1000 a month if I choose to. I just don’t know what to do or if it’s even a smart idea to invest considering I don’t have a real job so I’m not even paying taxes ?.. Any ideas?

It’s always a good idea to invest, and your future self will thank you! My go-to is Wealthfront (#2 in this post). It’s just as easy as Acorns but without the problems. I’d suggest opening a Roth IRA with them. The annual contribution limit for an IRA is $6,000, so if you set up an automatic contribution of $500 a month, you’ll max it out every year and be able to enjoy tax-free gains decades later when you retire.

Not sure exactly how your tax filing works, but a quick clarification that to contribute to an IRA, you will need reported earned income for that year (so if you want to put in the full $6,000, you need at least $6,000 earned income reported on your tax return).

I know you’re young but when the time of retirement came what actions would you take? Would you reallocate your investment options by moving to more secure options of investing or would you cash out for an annuity? I’m about two years from retirement and just not sure of how to handle my contributions once I’ve retired.

Yep, I would readjust my risk tolerance as needed so my portfolio has a higher percentage of stable, low-risk stocks & bonds. I don’t hear good things about annuities so I’d stay away from that option.